Increased throughput and lower latency facilitated by mmWave technology will result in faster handset upgrade cycles and enable new services which translates into improving 5G licensing opportunities. This can lead to billions in industry revenue through technology and patent licensing. The timing is fortuitous as 5G / LTE device shipments are declining as recently attested to by Qualcomm’s 20%+ and Nokia’s 15% declines in device licensing revenues. Unless a new must-have feature or a new performance paradigm is introduced such as what can be enabled by mmWave there is little hope that device licensing will escape its current doldrums.

Dense 5G mmWave infrastructure deployment both outside and indoors is needed to spur consumers and businesses to upgrade their devices to take advantage of the fastest network speeds and lowest latency of 5G. Unfortunately, many operators are not planning to roll out mmWave soon due to its high deployment costs. Even very advanced countries such as South Korea has taken back mmWave frequency because operators balked at the costs of meeting their deployment obligations.

Lowering equipment costs will spur operators and private network providers to stop delaying and purchase more mmWave equipment. This can only happen if the economics of mmWave deployment make sense. The Alium Open RAN Radio Unit pool can play an important role as it brings cost certainty to radio unit manufacturers thus fostering supplier diversity and competition and hence lower prices, as discussed in a 2023 economic report authored by Harvard Business School Professor Josh Lerner and Bella Private Markets.

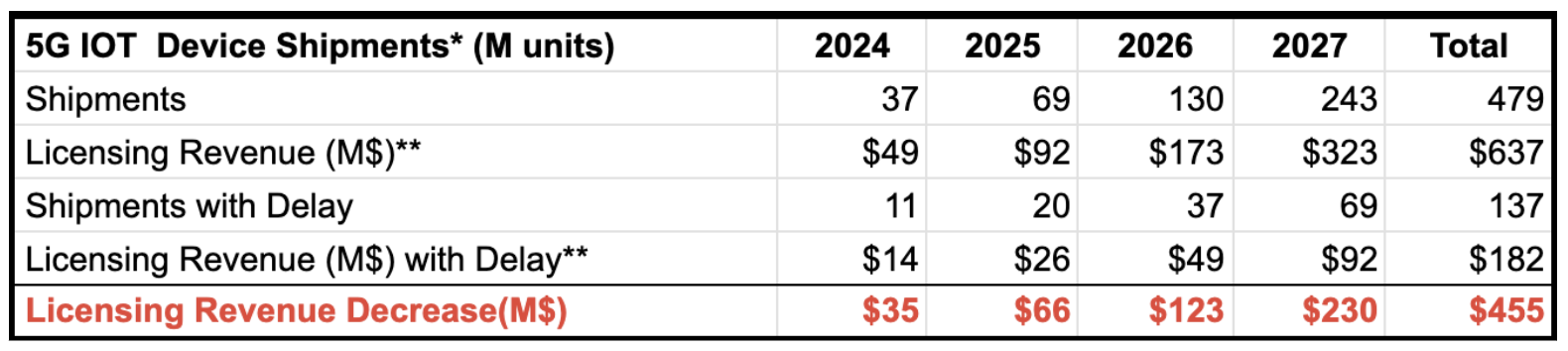

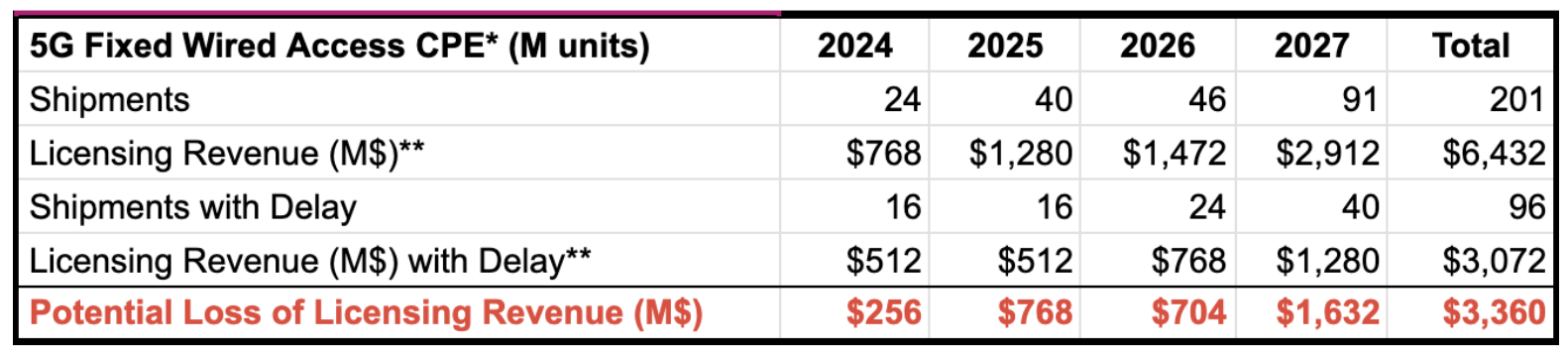

A number of other device licensing markets stand to gain greatly from the timely and robust deployment of mmWave infrastructure. For instance, the 5G IoT and 5G fixed wireless access (FWA) markets are in their infancy and, without a diverse, competitive mmWave radio unit market, rollouts will be pushed out.

Alium helps enable more market competition for mmWave radio units, thereby decreasing prices and accelerating network deployments. This in turn will spur users to purchase more and higher valued IoT devices faster to take advantage of the better network capabilities of mmWave. We modeled the results and found a 2 year delay in rolling out 5G mmWave infrastructure amounts to a loss of $455 million in licensing revenue over a four year period.

The loss of potential licensing revenue for Customer Premises Equipment (CPE) needed for 5G FWA over the same period could amount to $3.36 billion.