When Unified launched its Open Source Zone a little over 2 years ago, companies such as IBM, Microsoft, and the Linux Foundation teamed up with Open Invention Network to stop NPEs, specifically Patent Assertion Entities. At the time Unified found that 59% of litigation in this area was attributed to NPEs.

While the term “Open Source” can be ubiquitous with the current advances in technology, the Covid pandemic created the perfect storm of operating companies trimming resources and patents. NPEs, being backed by 3rd-party litigation financing, saw this opportunity to pounce on these patents making Open Source a viable target.

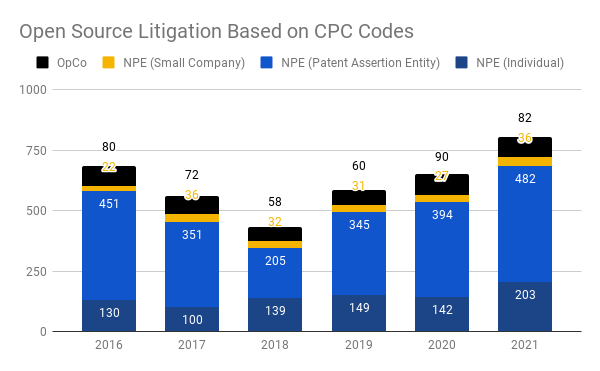

Using CPC codes related to Open Source patents, litigation by NPEs (Patent Assertion Entities) has increased 22%, while Operating Company litigation has decreased by 9%.

NPE litigation in Open Source has reached an all-time high of 721 cases. This is a nearly 28% increase from last year.

Top plaintiffs include prolific NPEs, including ones that are financed like Uniloc. Typically players, like multiple Rothschild entities, can be found in the top-10 most aggressive entities attacking Open Source.

Since Open Source can be defined broadly using CPC codes, a keyword search was done to understand the true impact of NPEs suing Open Source companies. Keywords such as “Open Source”, “Royalty Free Agreement/Software”, and “License or GNU or Android or Linux” were used.

Again, NPE litigation increased nearly 16% while Operating Company Litigation remained the same from last year.

This means that over 70% of all cases are brought by NPE.

Majority of assertions are brought by NPEs, with 8 out of the top-10 being defined as a NPE. It is no surprise that companies like Uniloc and WSOU appear in the top-10.

Most of the defendants are well-known technology companies, such as Google, Samsung, and Apple.

Unified Patents launched this zone two years ago in response to the increased litigation. Our efforts have led to 10 related PATROLL contests to find prior on several highly litigated patents. In addition, Unified has filed many challenges which has deterred NPEs.

Some of the PATROLL contests include Cedar Lane Technologies - US 8,165,867, R2 Solutions - US 8,341,157, R2 Solutions - US 8,341,157, and Rothschild Patent Imaging - US 9,936,086.

Recent IPR challenges include DataCloud Technologies, an IP Investment Group entity. DataCloud asserted US 6,560,613 relating to disambiguating file types on a computer system (accuses Linux kernel KVM and QEMU modules). This NPE asserted the patent against 10 companies, including Box, Extreme Networks, F5 Networks, 1&1 Ionos, Wix.com, Arista, Squarespace, Limelight Networks, Check Point Software, and Newfold Digital. Unified filed this challenge on December 22, 2020, and it was instituted on July 21, 2021.

Another example is Accelerated Memory Tech, which is also a subsidiary of IP Investment Group. This NPE asserted US 6,513,062 relating to managing resources to cache information to the cloud (accused use of open source project, Redis). There were five entities sued including Hulu, Citrix Systems, Barracuda Networks, Kemp Technologies, and F5 Networks. The IPR was terminated due to the patent owner disclaiming all claims of the patent.

Unified has also expanded its efforts and recently filed an Ex Parte Reexamination against Sound View Innovations. This NPE asserted US 6,725,456 relating to ensuring quality of service in an operating system (accused Apache Hadoop). The patent was originally owned by Nokia, and was asserted against Vudu, Walmart, Delta Air Lines, Cigna, Sling TV, and DISH Network. Unified filed the reexamination on August 6, 2020.

Copyright © 2022, Unified Patents, LLC. All rights reserved.