*updated on May 27, 2025

The Patent Office is in a period of transition. Director Vidal left her post in December 2024, and the new administration’s appointee has not yet had a first day. Nonetheless, the acting director has made sweeping policy changes at the Patent Trial and Appeal Board. On February 28, acting director Coke Morgan Stewart rescinded Director Vidal’s guidance memo clarifying the standard for discretionary denial based on parallel litigation. The memo had, among other things, made Sotera stipulations dispositive of the Fintiv question, required panels to use established time-to-trial statistics instead of aspirational scheduling orders in addressing the second factor, held that Fintiv did not apply to ITC cases, and which promised not to reject petitions that made a compelling showing of invalidity on the merits.

The acting director has also unilaterally created a bifurcated review process where she will have the first and final say on discretionary denial. *The new procedure guarantees patent owners 47,600 words with which to fight a petition, and indicates another 5,600 words will be allowed for a reply to a petitioner’s discretionary denial opposition (bringing the total to 53,200). A petitioner has 19,600 words to make a case for invalidity, confirm compliance with procedural requirements, and rebut substantive arguments, and another 14,000 words are earmarked to address discretionary denial if raised. By making discretionary denial briefs 14,000 words each, the acting Director elevates these ancillary issues to the level of importance of the merits of invalidity.

Fintiv, a policy decision that received overwhelming public opposition and drew the ire of lawmakers when the Office attempted to formalize it through rulemaking, has made it harder to challenge invalid patents at the Patent Office. And current practice under the acting director’s new policy exceeds Fintiv in both scope and effect. Unsurprisingly, the interim director’s actions have already resulted in significantly more discretionary motions and denials and had an even more dramatic impact than the Fintiv decisions that preceded it.

The last time we prepared a quarterly report on discretionary denials, only one Fintiv-related denial had been entered in an entire quarter. We suspended reports when these types of denials fell close to zero.

In the first two months of this quarter, prior to the interim administration’s actions, there were no denials under these factors; in March alone, there were eight. In April, there were 29 more denials—more than two-thirds of the 42 institution decisions addressing Fintiv issues.

With this significant rout in April, now less than half of the 103 institution decisions addressing parallel litigation have been instituted without contest this year.

In the first quarter of 2025, over 300 decisions on institution were entered, over two-thirds of which were instituted. Of the ones denied, only about 5% were for discretionary reasons, and only 3% were due to parallel litigation:

But in April alone, over 60% of institution decisions have been denied, with Fintiv-based denials making up about 40% of the 65 denials:

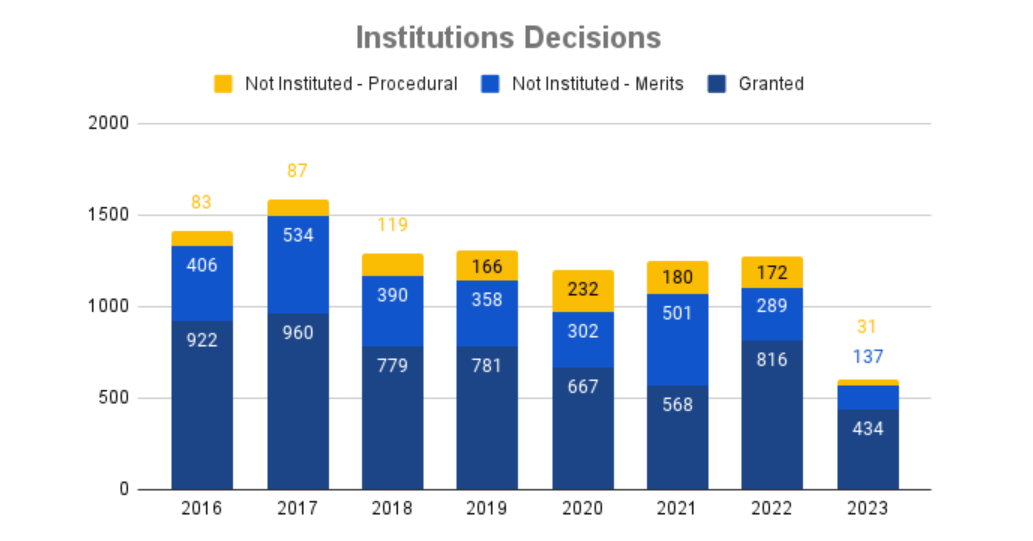

For context, we previously reported 167 denials under 314(a) for the entire year of 2020, the year with the most denials—just over 13 a month on average:

The USPTO is now on pace to quadruple discretionary denials under the new enhanced interim procedures.

A deeper analysis of panel decisions suggests an aggressive policy to gatekeep IPRs more than Fintiv ever did. The next chart breaks down how panels ruled on the individual Fintiv factors this quarter in every case where any factors were addressed. Specifically, we checked whether a given factor was found to favor institution, be neutral, or favor denial.[1]

Factor 1: The pointless factor

The first Fintiv factor relates to the likelihood that a district court will grant a stay. However, although some level of speculation is necessary to assess the “likelihood” of something, panels routinely decline to address this factor. In practice, factor 1 is deemed neutral unless the district court expressly indicates that they would grant a stay or has already decided on the issue, which rarely happen. Some, but not all, panels will weigh the factor slightly against institution if a stay motion was denied without prejudice.

What’s more, the acting director has given this factor no weight despite an ongoing stay. In Motorola Solutions v. Stellar LLC,[2] the director had found that a panel had mis-weighed factors 3 and 4. However, the director declined to revisit the panel’s finding on Factor 1, the likelihood of a stay, despite that the court had since stayed the case. The panel originally found that factor 1 favored denial because a stay was unlikely. Motorola, Paper 19 at 4. They guessed wrong. The district court did grant a stay because trials were either instituted or pending for all asserted patents.

Under the old framework, this should have strongly favored a stay. Fintiv instructed that “[a] district court stay of the litigation pending resolution of the PTAB trial allays concerns about inefficiency and duplication of efforts.” Fintiv, Paper 11 at 6. But instead of giving this new information any weight, the Director indicated in footnotes that the district court might lift its stay now that the director was denying the first four IPRs and confirmed that she would deny the remaining four “if and when” the patent owner requested review. Motorola, Paper 19 at 4 n.5–6.

Interestingly, even after the Director reversed the institutions, the district court maintained its stay, citing the rehearing request and the fact that it still had 29 pending motions to address. Stellar LLC v. Motorola Sol’ns, Inc., No. 4:23-CV-750-SDJ, Doc. 170 (E.D. Tex. April 21, 2025). For now, neither the district court nor the PTAB filings are proceeding.

Factor 2: Multi-weighted factor

Factor 2 turns on whether the trial date for the district court case will be before or after the final written decision date. And although the 2022 guidance memo was rescinded, panels are still willing to reject unrealistic scheduled trial dates for now. See, e.g., Samsung Electronics Co., Ltd. v. Mullen Industries LLC, IPR2024-01472, Paper 9, 8–9 (PTAB Mar. 31, 2025) (review request pending).

The result of factor 2 influences how factors 3 and 5 will land, especially given the director’s recent decision in Motorola. Where factor 2 was neutral or favored institution, factor 3 also favored institution 85% of the time. But in the 52 cases where factor 2 favored denial, factor 3 favored institution only 34% of the time. In Motorola, the director emphasized that where a trial date was scheduled for eleven months before the deadline for the final written decision, factor 3 should be given more weight than factors favoring institution. Motorola, Paper 19 at 3. And, as discussed below, some panels say that factor 5 swings with factor 2 whenever the parties are the same.

For cases involving multiple petitioners, the panel is likely to use the fastest trial schedule, as shown in the seven denials involving disputes between Universal Connectivity and Dell, Lenovo, and HP.[3]

Factor 3: Unpredictable, but shifting trends favor denial if Markman hearing held

In the original Fintiv decision, the panel stated that “[i]f, at the time of the institution decision, the district court has not issued orders related to the patent at issue in the petition, this fact weighs against exercising discretion to deny institution.” Fintiv at 10. The examples of orders given dealt with substantive matters such as preliminary injunctions and claim construction. Id.

But panels have been all over the place on how they address the third Fintiv factor. Most panels compare what has been done with what remains to be done in the district court case, such as expert discovery, and balance this with factor 4. Compare e.g., Samsung Display Co., Ltd. v. Pictiva Displays Int’l Ltd., IPR2024-01222, Paper 12 at 7 (Mar. 6, 2025) (weighing factor 3 in favor of institution given that expert discovery had not begun) with Adobe, Inc. v. Jonathan E. Jaffe, IPR2024-01352, Paper 8 at 11 (Mar. 7, 2025) (review request pending) (weighing factor 3 marginally in favor of denial in light of tentative construction, noting that fact discovery had not occurred). Panels will also give credit to a petitioner’s diligent filing, although they are inconsistent about what counts as diligent. See, e.g.,Samsung Electronics Co., Ltd. v. Headwater Research LLC, IPR2024-01396, Paper 13 at 7 (Apr. 1, 2025) (noting that petitioner’s diligence in filing the IPR “approximately 4 months” before statutory deadline weighed against denial).

The Motorola decision dealt with a matter in which claim construction was done and some discovery, including expert discovery, had already been undertaken. Motorola, Paper 19 at 3. Therefore, it is not comparable to the average case when it comes to the weighing of factor 3. While Motorola addressed the weight of the factor, not where it landed, there has been a recent trend of decisions weighing this factor as neutral or even in favor of denial if a Markman hearing had been held at all, even if no decision had been entered. See, e.g., Samsung Electronics America, Inc. f/k/a Samsung Telecommunications America LLC v. Collision Communications, Inc., IPR2025-00011, Paper 12 at 21–22 (Apr. 28, 2025).

Given the departure from the original Fintiv decision, there is very little predictability in how a panel will weigh factor 3. This is unfortunate because the third factor is one of the most determinative factors. Since the recission memo, where factor 3 favors institution, the petition has been granted nearly 80% of the time, but where factor 3 favors denial, the petition is denied 75% of the time.

Factor 4: Often favors institution, but has less impact than before

Pre-Motorola, stipulations like those provided in Sotera and Sand Revolution negated overlap between district court and PTAB proceedings. Now, these stipulations are less effective.

Specifically, the acting director has implied that because the petitioner had other types of invalidity arguments in the district court, the stage of the litigation would outweigh even a Sotera stipulation. Motorola, Paper 19 at 4 (“Petitioner’s invalidity arguments in the district court are more expansive and include combinations of the prior art asserted in these proceedings with unpublished system prior art, which Petitioner’s stipulation is not likely to moot.”).

This is a departure from Fintiv, which was not concerned with whether the IPR would moot all invalidity issues at the district court, but the opposite: whether the litigation would “resolve key issues in the petition” before the Board would have a chance to decide. Fintiv at 13. IPR proceedings have fewer invalidity options available to petitioners than district courts because it helps the PTAB stay nimbler and resolve the more cut-and-dry questions that publication-based prior art challenges provide. By statutory design, IPRs cannot address all types of invalidity issues, so the Motorola decision will substantially weaken factor 4 even when it strongly favors denial.

And this has played out. Since the director’s decision in Motorola, institution has been denied in 40% of cases where factor 4 favors institution (19 out of 47).

Factor 5: Split decisions where parties are the same

Panels agree that factor 5 is not assigned much weight when the parties are the same and holds more weight when the parties are different.

Where the parties are unrelated to those in district court, this factor favors institution.

But in the vast majority of cases, the petitioner and patent owner are the same parties that are in the parallel litigation. There are three approaches to weighing this factor in such cases:

Most panels find that this factor slightly weighs in favor of denial when the parties are the same. See, e.g., Adobe, v. Jaffe, Paper 8 at 12–13 (acknowledging split).

Other panels say that factor 5 is merely neutral when the parties are the same. See, e.g., Shenzhen Root Technology v. Chiaro Technology Ltd. d/b/a Elvie, IPR2024-01296, Paper 9, 19-20 (PTAB Feb. 25, 2025) (acknowledging split).

Finally, some panels have held that this factor weighs against denial when the parties are different and falls the same way as factor 2 when the parties are the same. See, e.g., BOE Technology Group Co., Ltd. V. Optronic Sciences LLC, IPR2024-01130, Paper 16, 13 (PTAB Jan. 27, 2025).

Factor 6: Never favored denial…until April

In the first quarter, no panel found that factor 6 weighed in favor of denial—at worst, it was neutral.

However, in April, boards found that Factor 6 weighed in favor of denial in more than a quarter of the month’s decisions. Specifically, some panels have held that if a petition has a weakness, then factor six would favor denial if any other factor favors denial. See, e.g., Dell Inc. v. Universal Connectivity Technologies Inc., IPR2024-01480, Paper 12 at 13–14, 22 (Apr. 24, 2025). And one panel denied institution despite finding strong merits, which was rare even before the Director’s 2022 guidance. Nokia of America Corp. v. KT Corp., IPR2025-00036, Paper 14 at 17–18 (Apr. 25, 2025).

[1] Ten of these cases represent pre-rescission decisions in which the petitioner entered a Sotera stipulation to avoid denial. In all but one of those cases, factor 4 was the only factor considered.

[2] It is worth noting that Stellar LLC is an entity funded by hedge fund Davidson Kempner, something never addressed or disclosed to the Board.

[3] According to data from RPX, these matters are funded by an affiliate of Owlpoint Capital Management, LLC.