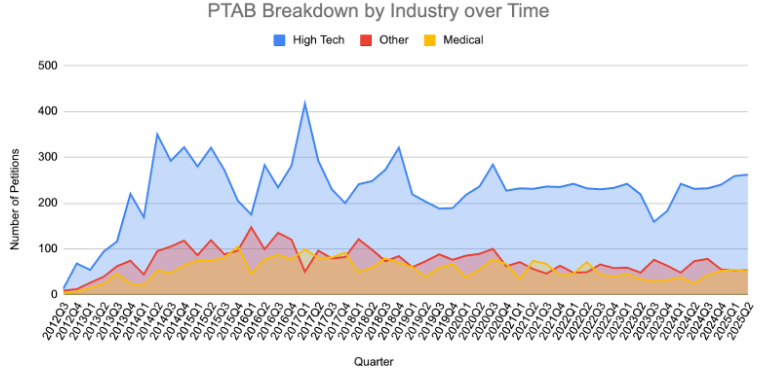

Following new guidelines introduced in February and March 2025, discretionary denials at the Patent Trial and Appeal Board (PTAB) reached an all-time high in the third quarter of 2025. These changes, including a bifurcated review process, expanded discretionary denial factors and revival of the Fintiv test, have also caused the overall institution rate to drop.

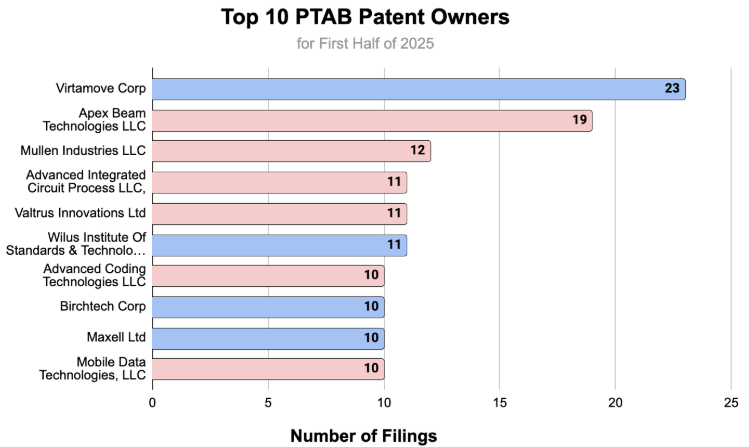

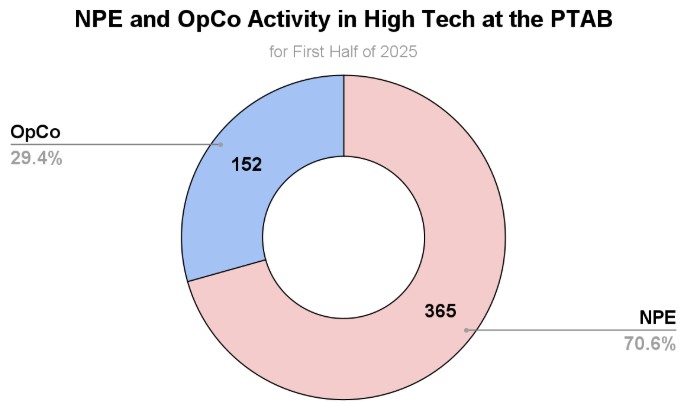

In addition, the USPTO has said recently that patents that have been issued for more than six years (or sometimes, less) can create "settled expectations," such that IPR (inter partes review) challenges should be denied. But the vast majority of challenged patents at the PTAB have been well beyond six years of age. And NPE (non-practicing entity) patents have been materially older—a result of older patents changing hands later in life and being asserted well after their useful life by operating companies. In fact, the data indicates that the average age for a challenged NPE patent in the PTAB is 16.3 years, while the average age for a challenged OpCo (operating company) patent in the PTAB is 12.6 years.

The settled expectations theory leads naturally to NPEs having a far lower institution rate—i.e., petitioners challenging NPE patents are far more likely to be denied—given they are materially older.

As a result, while the institution rate against NPEs historically has been higher than the institution rate against operating companies, this trend has reversed, with the NPE institution rate now significantly lower.

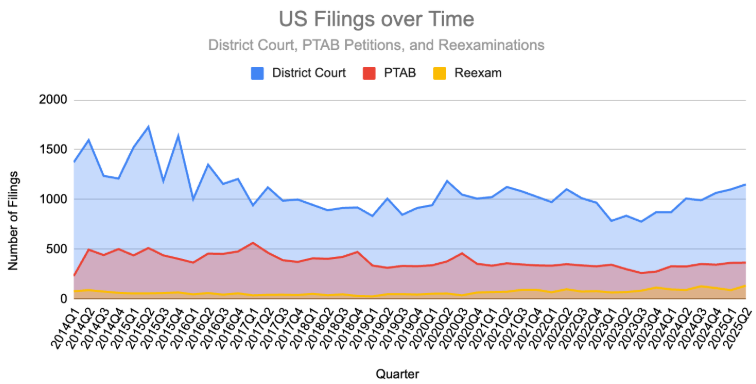

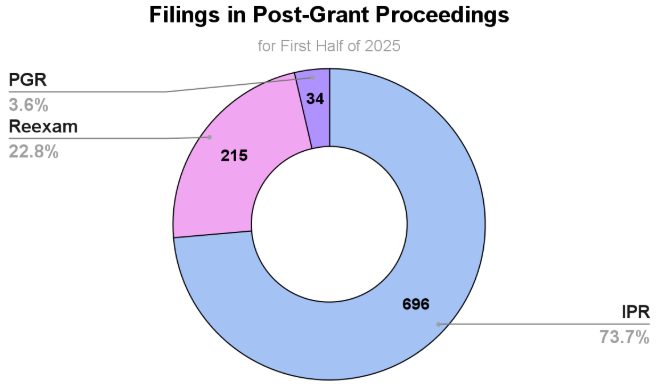

Despite the decrease in institutions, PTAB petition filings saw only a modest 3.5% decrease between Q2 and Q3. The future volume of filings is uncertain, especially with new PTAB rules effective September 1, 2025 that restrict the use of “general knowledge,” such as expert testimony, common sense, or applicant-admitted prior art.

In contrast, requests for ex parte reexaminations reached an all-time high during the first nine months of 2025, jumping by 46% between Q2 and Q3, suggesting that would-be PTAB petitioners were looking for an alternative venue to challenge patents.

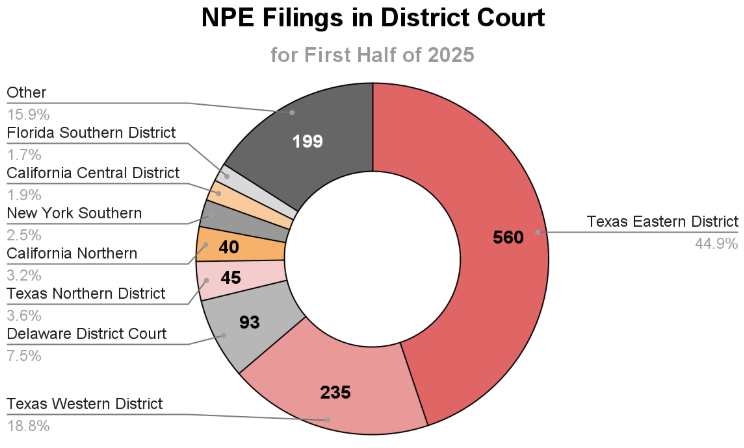

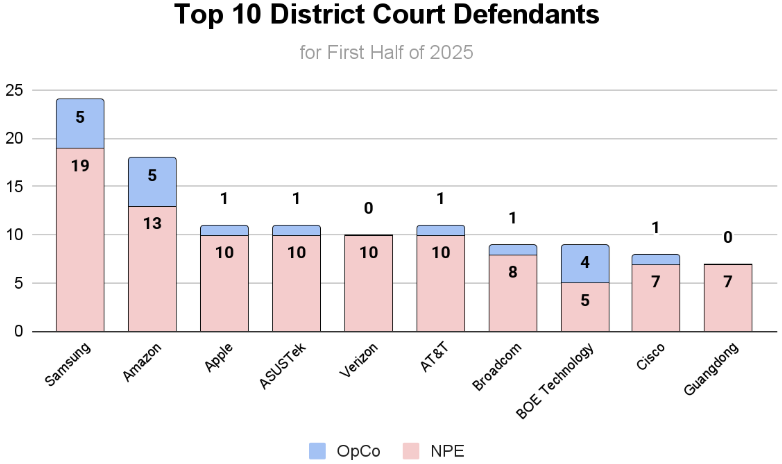

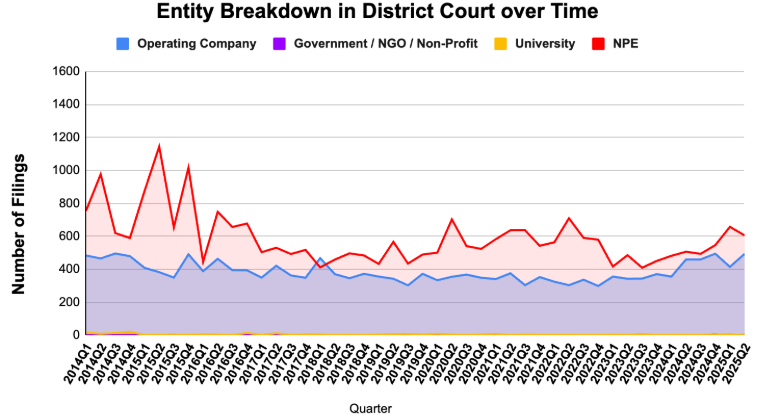

Meanwhile, in the federal district courts, the number of patent filings dipped 8.9% between Q2 and Q3. The Eastern District of Texas continues to be the most popular venue for patent case filings, including filings by NPEs.

Additional takeaways:

Based on the first nine months of 2025, PTAB, ex parte reexamination, and district court filings currently remain on pace to exceed 2024’s numbers.

The W.D.Tex. remains the second most popular venue for patent filings and NPE patent filings in the first nine months of 2025. However, it is a distant second to the E.D.Tex. Combined, the E.D.Tex. and the W.D.Tex. accounted for 40% of all patent cases filed in the first nine months of 2025 and 62.8% of all NPE cases filed during the same time period.

In the Unified Patent Court, the number of infringement actions filed in the third quarter of 2025 increased 42% over the first half of 2025.

Procedural Denials in PTAB Increase Significantly: The PTAB issued a record-high 254 denials in the third quarter of 2025. This marks a 77.6% increase over the first half of the year and a 206% increase in procedural denials compared to all of 2024.