Overview

No matter the world’s economic situation, patent litigation appeared to be the one constant. However, the number of assertions in Q1 has stumbled for the first time in years. While LIE (Litigation Investment Entity) assertions are down, new assignments are up (see Blackberry’s recent announcement). Are LIEs loading up on assets to be litigated later?

Highlights:

With only 588 cases thus far, 2023 litigation is projected to be down 51% compared to 2022.

NPE (PAE) Activity has dropped nearly 54% to 187 from Q1 of 2022 with 410 cases and 407 in Q4 of 2022.

IP Edge and Cedar Lane assertions have dropped collectively 95% with only 7 cases this quarter from both Q4 of 2022 with 145 and Q1 of 2022 with 140.

Dynamic IP Deals and Jeffrey Gross have been the most litigious entities, with 24 assertions each.

Q1 saw at least 18% of NPE (Patent Assertion Entities) where the patent asserted had been assigned and funded to a LIE.

The Western District of Texas continued to be the most popular venue in 2023.

In Interdigital vs Lenovo, the UK court rejected InterDigital’s Top-Down approach while applying its own comparable analysis.

FRAND disputes will likely rise as Wi-Fi 6 adoption (and its core 3GPP technologies like beamforming, MU-MIMO, and OFDMA) increases.

Figure 1: 2023 projected cases will decrease by 51% when compared to 2022. proceedings and Reexaminations appear to remain on par with the last three trailing years. Explore this data further on Unified’s Portal.

Figure 2: Q1 2023 is 30% lower compared to Q4 2022 and 44% lower compared to Q1 2022.

Figure 3: At the PTAB, over 40% of challenges were NPE related in 2023.

Figure 4: While, 60% of litigation originates from an NPE, PAE activity has dropped nearly 54% to 187 from Q1 of 2022 with 410 cases and 407 in Q4 of 2022.

Figure 5: IP Edge and Cedar Lane assertions have drop collectively 95% with only 7 cases from both Q4 of 2022 with 145 and Q1 of 2022 with 140.

Figure 6: The Western District of Texas continued to be the most popular venue in 2023.

Figure 7: Judge Albright’s venue continues to dominate patent litigation in the WDTX during Q1 of 2023.

Figure 8: Even with the standing orders issued, NPEs continue to gamble in the WDTX accounting for nearly 90% of all filings

Figure 9: High-Tech litigation continued to dominate both district courts and the PTAB in 2023.

Litigation Investment Entity Tracker (LIEs)

Figure 10: By tracking reassignments, an estimated 83,492 patents were sold in Q1 2023. This number does not represent the pending Blackberry sale for $170M at closing. The purchaser, Malikie Innovations, is a subsidiary of Key Patent Innovations. Key Patent Innovations also owns Valtrus, which has asserted against Google and Red Hat.

Figure 11: Q1 saw at least 18% of NPE (Patent Assertion Entities) where the patent asserted had been assigned and funded to a LIE.

Figure 12: Dynamic IP Deals and Jeffrey Gross have been the most litigious entities. IP Edge, which has asserted the most over the past few years, only filed two cases in Q1. Intellectual Ventures is also resurgent, having filed nine cases this quarter.

Figure 13: Historically, IP Edge accounted for 55% of all litigation brought by LIEs. In 2023 that number was reduced to only 2.8%, with 67% of LIEs now coming from Dynamic IP and Jeffrey Gross.

Figure 14: IP Edge's two filings are a significant contributor to the decrease in new assertions, compared to 110 in Q1 of 2022 and 90 in Q4 of 2022.

District Court

Figure 15: NPEs account for about 50% of cases filed this quarter.

Figure 16: Nine out of the Top 10 asserting entities were NPEs. The only non-NPE suit is between Bayer and Corteva, involving herbicide-resistant enzymes. An NPE, Web 2.0, is suing platforms such as Google Docs, Zendesk, and others over online document sharing and retention.

Figure 17: The majority of defendants are high-tech companies.

Figure 18: Nearly 53% of litigation involves the hi-tech industry, while medical-related suits have increased to 12.9%.

Figure 19: NPEs targeted high-tech companies 95% of the time in 2023, while non-NPEs targeted high-tech companies only 14% of the time.

Figure 20: NPEs are still responsible for 86.4% of litigation in the High-Tech industry.

PTAB Disputes

Figure 21: PTAB challenges appear on track to be the same as in 2022 and 2021.

Figure 22: Approximately 70% of all PTAB petitions filed in 2023 involved High-Tech companies.

Figure 23: Approximately 54% of all AIA challenges filed in 2022 involved High-Tech companies petitioning NPE-controlled patents.

Figure 24: IPRs remained the most popular AIA proceeding, claiming 76.4% of all post-grant proceedings in 2022. Reexaminations were the second most popular, accounting for nearly 21.5% of all patent challenges at the USPTO. Explore this data further on Unified’s Portal.

Figure 25: Hi-Tech Companies such as Samsung, Google, Cisco, and Apple rounded out the list of top Petitioners this quarter.

Figure 26: While High-Tech patents are the primary focus of the PTAB, the medical/pharma patents are trending upward.

Reexaminations

Figure 27: Reexaminations are projected to be down by 20% with only 304 filings.

FRAND & SEP

In the recent UK high court decision InterDigital vs. Lenovo, Justice Mellor found that it was reasonable for Lenovo to reject InterDigital’s “Supra-FRAND” offers and that Lenovo, despite its sometimes dilatory behavior, had not disqualified itself from benefiting from InterDigital’s FRAND commitment.

Justice Mellor applied a comparable license analysis using InterDigital's 2017 license with LG, since LG’s product volumes and geographic mix was closest to Lenovo’s. This resulted in a lump sum payment to InterDigital of $138.7M. Justice Mellor’s blended per-unit rate was $0.17, which is significantly lower than InterDigital’s maximum public program rates of $.40 for 3G, $1.00 for 4G, and $1.20 for 5G.

Justice Mellow acknowledged the top-down approach used by Judges Selina and Biriss in the TCL v. Ericsson case and Unwired Planet v. Huawei, respectively. However, Judge Mellow’s rejection of InterDigital’s portrayal of such an approach in all its guises will lead to other venues reexamining FRAND - especially with SEP litigation likely increasing.

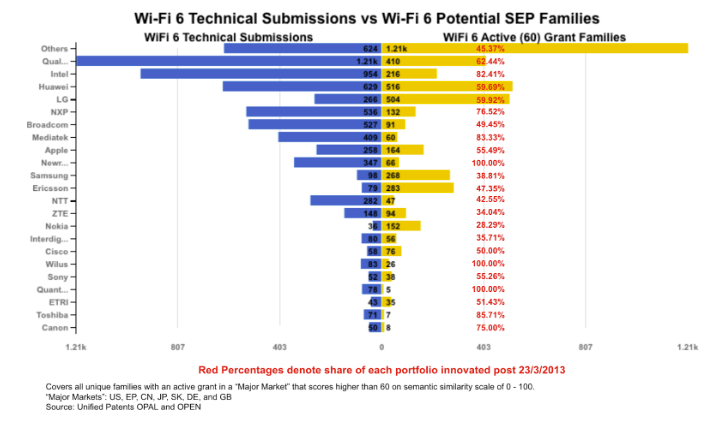

As seen in the chart below, litigation around Wi-Fi SEPs is heating up once again. The implementation in Wi-Fi 6 of heavily patented technology from 4G and 5G and the uncertainty in licensing Wi-Fi SEPs introduced by IEEE’s IPR policy changes effective as of the beginning of the year will likely fuel this trend. The ubiquity of Wi-Fi has only grown since 2014 as the market adoption of Wi-Fi 6 is outpacing its predecessors Wi-Fi 4 and 5. The number of Wi-Fi enabled devices shipped has grown 19.7% annually since 2014 with more than 4 billion shipments expected in 2022 alone. Further, information asymmetry between Wi-Fi implementers and SEP licensors is only growing as more and more industries are adding Wi-Fi “black boxes” to their products and services.

Figure 28: Patent litigation targeting Wi-Fi has steadily increased since 2014, as shown in the graph below. While non-practicing entities are leading the Wi-Fi litigation charge, the chart also indicates operating entities are increasingly pursuing litigation to resolve their Wi-Fi licensing claims.

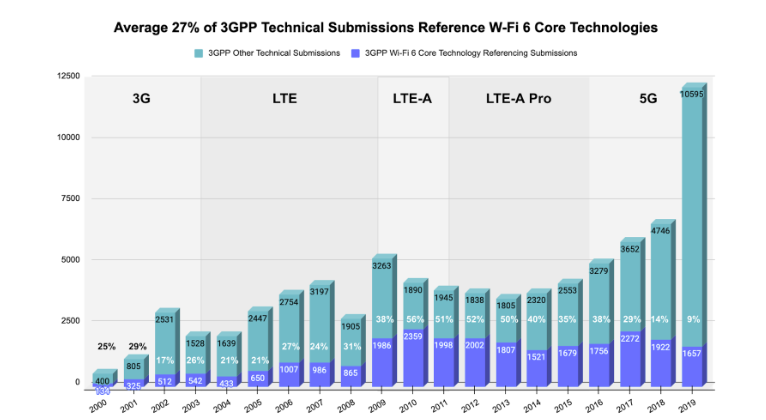

Figure 29: New Wi-Fi 6 core technologies such as Beamforming, OFDMA, and MU-MIMO figured prominently in technical submissions made earlier to the standardization of 3G, 4G, and 5G.

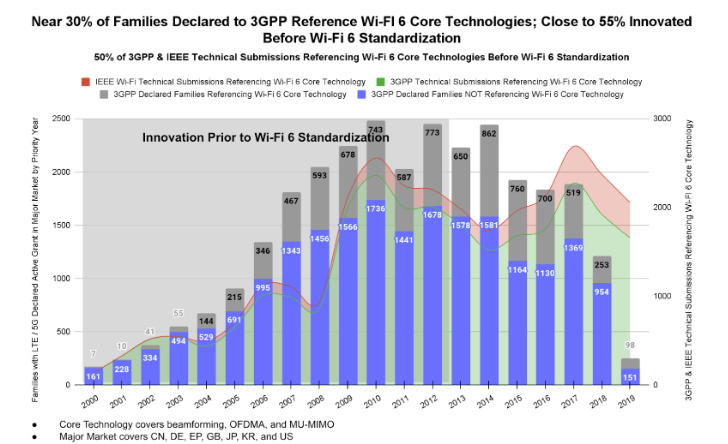

Figure 30: Patenting on the core Wi-Fi 6 technologies Beamforming, MU-MIMO, and OFDMA became a heavy focus starting in 2004 as shown in the timeline below.

Figure 31: Traditional 3GPP SEP holders could have strong Wi-Fi 6 portfolios originating from innovation occurring before the start of Wi-Fi 6 standardization in 2013-14.

Definitions

Sectors

High-Tech = Technologies relating to Software, Hardware, and Networking

Medical = Technologies relating to Pharmaceuticals, Medical Devices, Health Related Technologies

Other = Technologies relating to Mechanical, Packaged Goods, Sporting Equipment and any other area outside of high-tech and medical patents.

Entities

Non Practicing Entity (NPE) = Company which derives the majority of its total revenue from Patent Licensing activities.

Operating Company or Op. Co. = Company which derives most of its total revenue from Product Sales or Services. Could be an SME or a large company.

Other Entity = Universities / Non-Profits / Government / Non-Governmental Organizations (NGOs)

NPE (Patent Assertion Entities) = Entity whose primary activity is licensing patents and acquired most of its patents from another entity

NPE (Small Company) = Entity whose original activity was providing products and services, but now is primarily focused on monetizing its own patent portfolio.

NPE (Individual) = Entity owned or controlled by an individual inventor who is primarily focused on monetizing inventions patents by that individual inventor.

NPE Aggregator = Entity that has control or ownership over two or more entities.

Litigation Investment Entities = Evidence of any third party with a financial interest, other than the assertors.

Venues

CACD = Central District of California

CAND = Northern District of California

DED = Delaware

NJD = New Jersey

NDIL = Northern District of Illinois

SDNY = Southern District of New York

TXED = Eastern District of Texas

TXWD = Western District of Texas

Methodology

This report includes all District Court and PTAB litigations between January 1, 2015 and March 31, 2023.

Total number of reported cases can vary based on what is included. Unified made its best attempt to eliminate mistaken, duplicative, or changes in venue filings, hence the totals may vary slightly compared to other reporting entities. Statistics include litigations initiated by NPEs or Declaratory Judgments (DJs) initiated by operating companies against NPEs.

Unified strives to accurately identify NPEs through all available means, such as court filings, public documents, and product documentation.

Copyright © 2023 - Unified Patents, LLC. All rights reserved.